Hi my name is Adam and I work for HP today I'm going to show you the unboxing setup and installation of the HP Office jet Pro 8710 printer. The first thing we're going to do is open the box inside the box you'll find the installation CD for both Windows and Mac if in the future you misplace this disk you can download the software and drivers at 1 to 3 HP comm /OJ pro 8 7 1. The next CD in the box is the read iris pro installation disk read iris pro is optical character recognition software this software will convert written text into documents that can be edited on your computer. The next item is the setup flower which is the basic setup instructions for your printer similar to what we are showing in this video. Next is the HP ink cartridge caution flower here we have the HP instant ink guard for this printer. HP offers a subscription service for replacement ink if you subscribe your printer will order ink automatically for you based on the subscription plan that you choose. The last document in the box is the user guide for your printer this provides information on setting up additional features for your printer such as fax and web services. Next we have the power cord them two our phone cord for setting up your printers fax connection then we have the setup cartridges used to initialize the printer and calibrate ink levels these are the nine fifty-two black cyan yellow and magenta ink cartridges. Remove the cardboard and set it aside for recycling all HP package materials are capable of being recycled for more information about recycling with HP go to hp.com now.

PDF editing your way

Complete or edit your irs form 8718 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 8718 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 8718 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 8718 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 8718

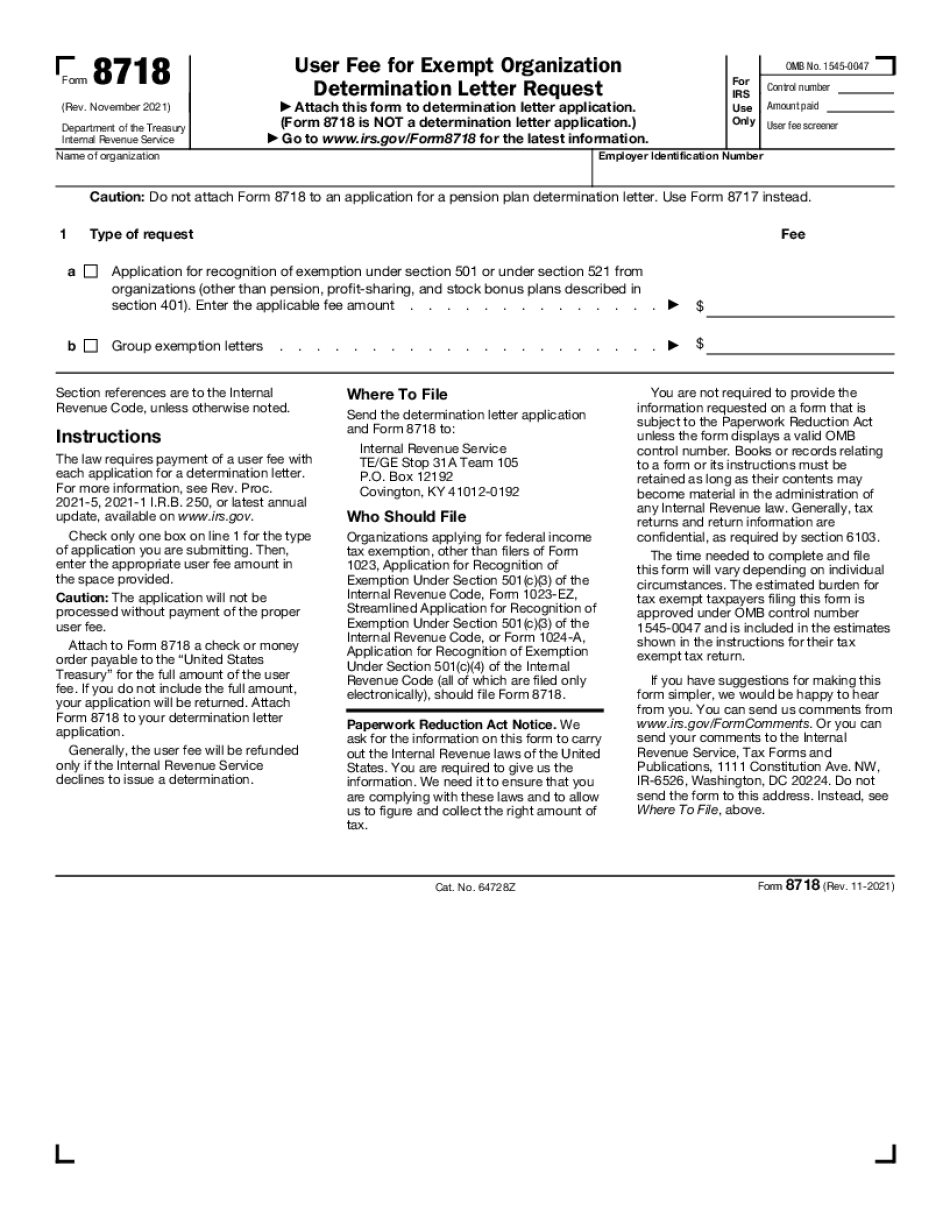

About Form 8718

Form 8718 is a tax form used to request an extension of time to make a payment of certain taxes. It is specifically designed for businesses and corporations that file information returns such as Forms W-2 and 1099, and may need extra time to pay their share of withholding taxes. Any company that fails to submit the correct amount to the IRS on time may be subject to penalties, interest, or other sanctions. By submitting Form 8718, businesses can ask for extra time to make their payments without incurring additional penalties. Overall, Form 8718 is a useful tool for businesses of all sizes to help ensure compliance with Federal tax law and avoid costly penalties.

What Is Irs 8718?

Online solutions help you to arrange your file administration and enhance the efficiency of the workflow. Observe the brief tutorial to be able to fill out Irs 8718, avoid errors and furnish it in a timely way:

How to complete a Form Fee 8718?

-

On the website hosting the document, click Start Now and go for the editor.

-

Use the clues to complete the pertinent fields.

-

Include your personal details and contact details.

-

Make certain that you enter true information and numbers in appropriate fields.

-

Carefully revise the data of your document as well as grammar and spelling.

-

Refer to Help section if you have any questions or address our Support team.

-

Put an electronic signature on your Irs 8718 printable while using the support of Sign Tool.

-

Once the form is finished, click Done.

-

Distribute the prepared form by using email or fax, print it out or download on your device.

PDF editor permits you to make changes in your Irs 8718 Fill Online from any internet connected device, customize it in line with your needs, sign it electronically and distribute in different ways.

What people say about us

It's a great idea to submit forms online

Video instructions and help with filling out and completing Form 8718