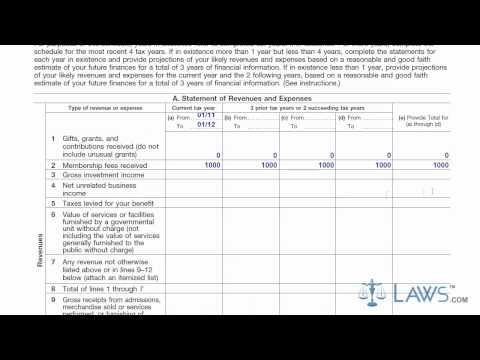

Laws.com legal forms guide Form 10:23 is a United States Internal Revenue Service tax form used for charities, nonprofits, and religious groups to seek recognition for tax-exempt status. The Form 10:23 can be obtained through the IRS's website or by obtaining the documents through a local tax office. In order to apply for tax-exempt status, you must fully complete the Form 10:23 and submit it to the IRS. To fill out the form: - Fill out Part 1, providing the identification information for the applying group in lines 1 through 12. - In Part 2, answer yes or no for each question on lines 1 through 5, providing the organizational structure of your group. - Part 3 provides a checklist for what is required in your organizing document in order to meet tax-exempt status. Ensure that each question is addressed on your organizing form before continuing with the Form 10:23. - For Part 4, you are required to attach a summary of your organization's activities. Additional informational attachments such as financial statements, brochures, or fliers may also help you complete your summary. - In Part 4, you must supply the compensation structure of all officers, executives, employees, and independent contractors of your organization. - In Part 5, further expand on employee relationships in lines 2 through 9, answering yes or no to each question. - Answer all of the yes or no questions in Part 7 & 8. - Fill out a financial statement in Part 9. - Establish your public charity status in Part 10, certifying that all your answers are accurate. Sign and date Part 11, attaching the required fee for the application. - Depending on your organization's status, attach additional schedules. For a church or religious organization, attach Schedule A. For an educational organization, attach Schedule B. For a hospital or medical facility, attach Schedule C. For significant...

Award-winning PDF software

1024 user fee Form: What You Should Know

With the new tax-exempt use tax certificate process). For guidance on how to complete Parts I through III of Form 1024, see . How to Use Form 1024 Form 1024 is an instruction application that allows exempt organizations to make adjustments to the tax-exempt organization's Internal Revenue Code (IRC) section 501(c)(3) tax-exempt status. It is intended for organizations and individuals that wish to change the exempt status of a Section 501(c)(3) tax-exempt entity. When filing, this form does not require individuals to complete an additional IRS identification number. The application must be filed as an attachment to Schedule A or Form 1099-B. It requires the name and address of the person filing the application, a letter from the tax-exempt organization authorizing the adjustment, and a statement of the specific adjustment that they wish to request. In addition to the application, you must file a copy of Form 1024 (with appropriate supporting documentation) with the Internal Revenue Service via any of the following methods: mail/fax or e-file (see IRS publication 605, Tax-Exempt Not-for-Profit Organizations and Organizations That Conduct Charitable Activities, available at ), electronic submission via secure portal at, or via the IRS e-file system (see IRS publication 657, Application for Adjustment of IRS Exemption Status — Exemption From Income Tax, available at ). How to Pay the Fees and Taxes on Form 1024 You submit Form 1024 online using the instructions published in the Form 1024 instruction booklet. If you have filed Form 1014, Form 1016, or a similar return under prior U.S. Treasury Department regulations and have not filed an amendment to that return, you must request Form 1024 through the online form (see ).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to Do Form 8718, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8718 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in Your Form 8718 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to Your Form 8718 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1024 user fee