Award-winning PDF software

Form 8718 online NV: What You Should Know

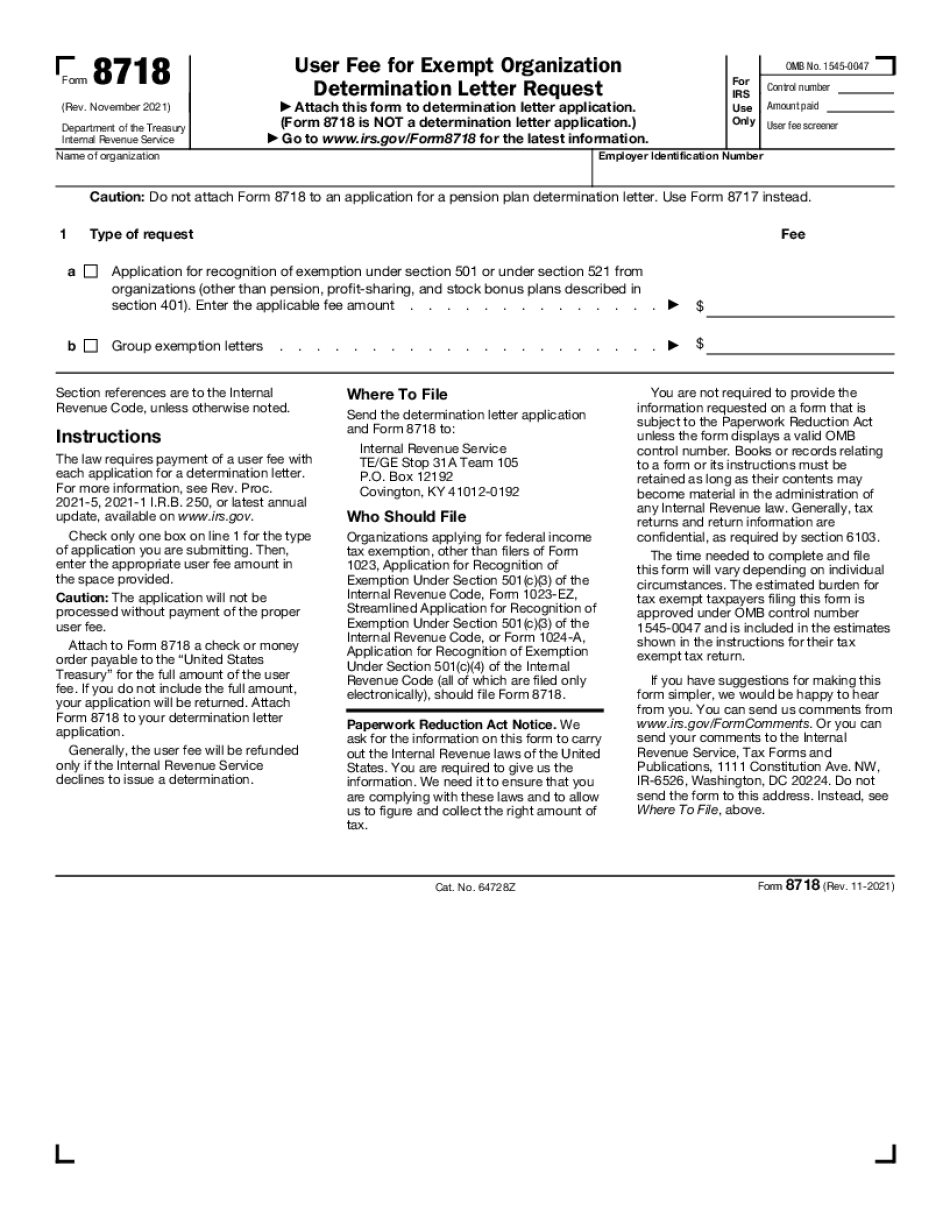

Online Form 8718 (Rev. November 2021) — IRS This form is a supplemental notice of non-taxable organization income tax for certain businesses that offer services or products for a fee (such as an e-commerce operation, a non-marketplace vendor or an online business). It is used if this type of business is required to pay a fee but does not receive the funds in kind (in other words, a check or direct deposit). If the business is subject to taxation for any other reason (such as an excise tax) and does not receive the funds in kind, this form is not effective as of 2014. If the business is non-taxable for any reason (for example, a partnership, S corporation, or other entity cannot make any distributions to its owners in Nevada without the state taxing the entity), the form is effective as of 2016. This form certifies that certain forms of online fee-for-service (affiliate) sales activity are exempt. The fee exemption of this form applies only to sales made on the Internet. If you choose to use this form offline and choose to use the online Fee-For-Service exemption to determine whether the online sales activity meets the exemption requirements, you will not be able to use this form to determine if the online activity qualifies as exempt. This form requires businesses that are subject to Nevada income tax (such as partnerships, S corporations, or other exempt business entities) to report their gross receipts, net of remittance or return filing, in the same filing status as all other Nevada small business income tax filing or reporting business. This form will report total revenue (before any withholding) to the state, including state and local franchise, franchise tax, gross receipts taxes and any other tax imposed under NRS 408.1(5). This online form must be submitted on paper to the IRS. You must complete Form 8718 online (or, more accurately, Form 8718-A2 (Revised)) and then submit it electronically to the IRS. This form must be completed on paper and then submitted via the online fee-for-service (affiliate) sale activity reporting program to the IRS. This form cannot be completed offline and cannot be submitted online. Fee-for-Service (Affiliate) Sales Activity Report— IRS This is an informational report for all businesses that are required to pay or claim an exemption from Nevada income tax based on activities of affiliate affiliates and their agents.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8718 online NV, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8718 online NV?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on Your Form 8718 online NV aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with Your Form 8718 online NV from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.