Award-winning PDF software

Form 8718 online DE: What You Should Know

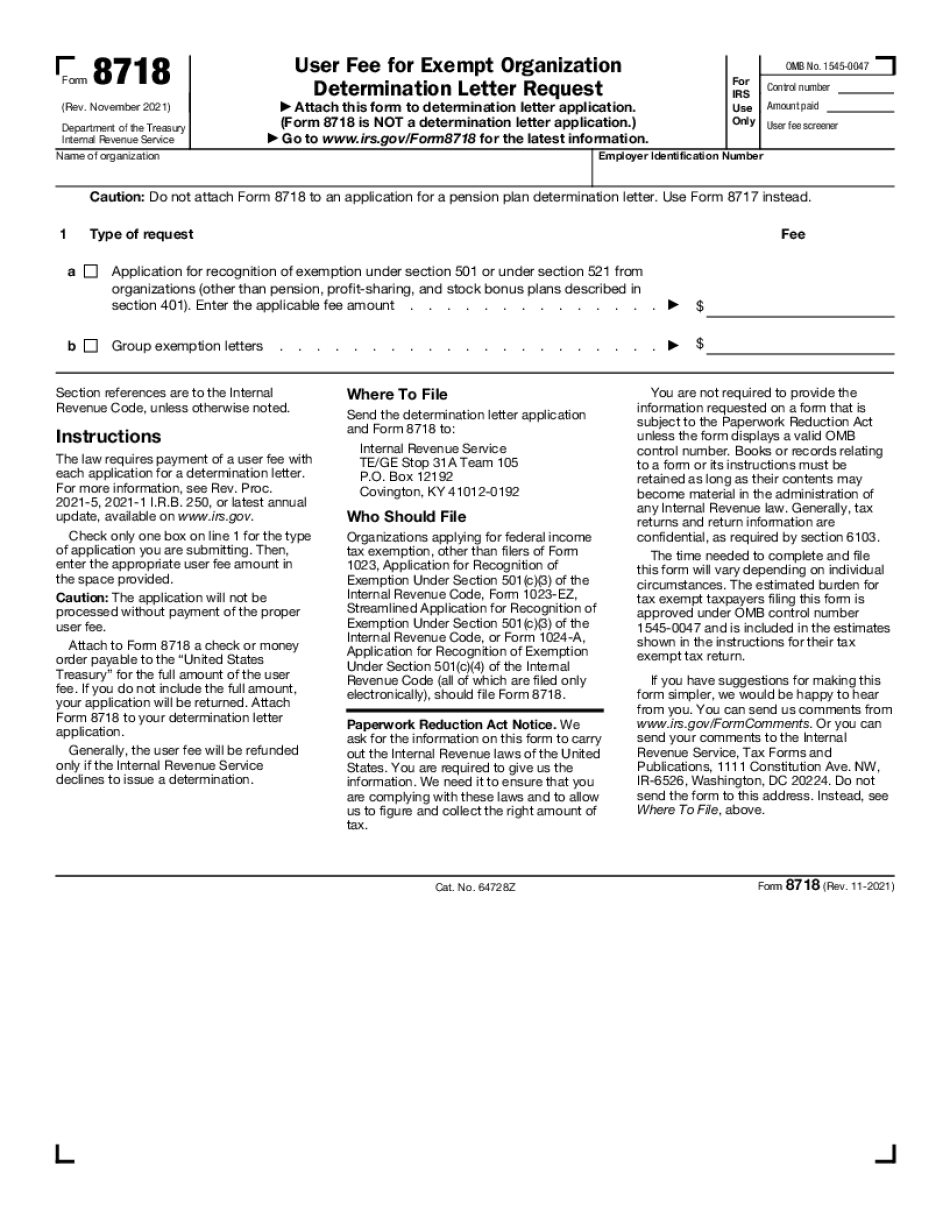

Date organization started with the government and 3 years before. 4 Number of organization employees. 5 Type of organization. The IRS considers a group to be an “employer” if any of the following are true: 5 or more full-time employees whose work is in connection with the organization. 6 or more part-time employees whose work is in connection with the organization. 7 or more contractor employees who perform services related to the organization. 8 or more volunteer employees who perform services related to the organization; and/or 9 or more contract volunteer workers who work under a contract or for profit. 10 or more contractor labor contractors engaged by the organization or other third party. 11 or more worker volunteers under contract to the organization. 12 or more contractor labor contractors who will receive and pay the organization's wages or other compensation in connection with the organization; 13 or more worker volunteer coordinators 13 on any work to be done pursuant to the organization's contract with the organization 14 or volunteer labor coordinators on any work to be done pursuant to the organization's contract with the organization 15 or any other persons whose work is in connection with the organization whose names are listed for the organization in section 15 of the IRS regulations or the Proviso to Form 8718 and Proviso to Form 8801. 16 or an organization that qualifies as a charitable organization. Note: Taxpayers may electronically submit a completed tax return from a remote location by: 1) uploading Form 8501 or Form 8606 using IRS-owned remote portal at and 2) uploading and viewing Form 8718, along with corresponding attachments using the same remote portal. Form 8606 provides the tax information necessary to prepare and file a return for a foreign affiliate. The IRS requires Form 8501 to be filed by the affiliate. You cannot file Form 8501 electronically. When an affiliate files a combined Form 8606 with a foreign return, the filing of the associated combined return automatically triggers a filing of the Form 8606 (with corresponding attachments) with the foreign return. In addition, in Form 8606/8606.01, the affiliates must also indicate whether they received Form 8606/8606.01. If the Form 8606/8606.01 for a foreign entity's filing with the IRS is received electronically, follow the instructions in the Form 8606 instructions to complete and submit a paper Form 8801.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8718 online DE, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8718 online DE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on Your Form 8718 online DE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with Your Form 8718 online DE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.