Award-winning PDF software

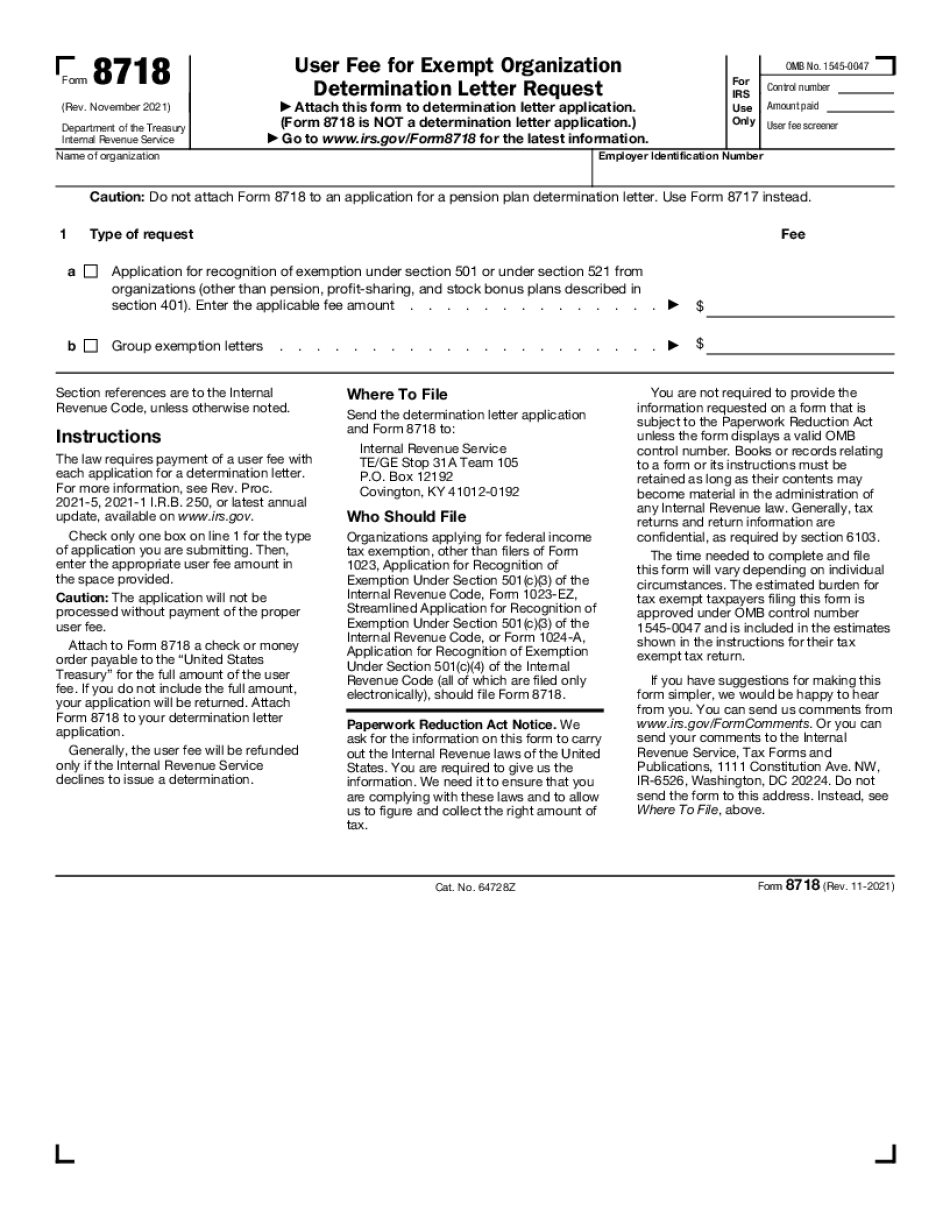

Printable Form 8718 Sunnyvale California: What You Should Know

These forward-looking statements are made under the safe harbor as to financial risk that is created by the fact that the Company is subject to significant credit risk, which may adversely affect the Company's financial condition and results of operations. Forward-looking statements include but are not limited to predictions of our revenue, operating results, operating expenses, cash needs and plans of management. You should pay particular attention to the provisions contained in Part I, Item 1A. Risk Factors for a discussion of the Company's material financial and operating risks and in the rest of this 10-Q, including the risk factors contained in Part I, Item 1A and Part II, Item 1B. Of the Quarterly Report on Form 10-Q. You are encouraged to analyze the Company's results in light of these risks. Please Note: We are not required to provide any tax advice. A qualified tax advisor should have sufficient and appropriate experience in working with taxpayers, tax professionals, and/or tax-related subject-matter experts to provide you with specific tax advice. We strongly advise that you obtain tax advice only on the basis of your own evaluation of all matters tax-related and not as a substitute for the analyses, comments and/or advice of a qualified tax advisor who is knowledgeable about the matters to be discussed. Form I-864, U.S. Individual Income Tax Return — Filed by You can complete this IRS form using any software that can print. If you use Microsoft Word, you would use a print button located on the top right-hand side of the page. Then choose “Print Document (PDF) & Print To File.” For your convenience, you can also click here to view and print the PDF file. A tax preparation professional can also use this IRS form if you use Google Docs, although the IRS has limited online access. You can click here to view the PDF file. Note If you do not receive a paper tax return, check with your tax preparer, and check that your address is correct. Form 1098 — Miscellaneous Form 1099 — U.S. Corporate Income Tax Return If you are a small business, use this form to report income and pay your tax. If you are a sole proprietor, use this form to report tax payments.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8718 Sunnyvale California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8718 Sunnyvale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8718 Sunnyvale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8718 Sunnyvale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.