Award-winning PDF software

Cambridge Massachusetts online Form 8718: What You Should Know

S. Federal income taxes under Subchapter K of Chapter 3 of Internal Revenue Code (IRC) Section 501(c)(3), with the tax collector for the State of Massachusetts for the period of twelve calendar months in which the association's tax return covering the earlier period was filed. What is required to register? The Form 1313-A, Annual Registration Statement. A copy of all the documents or evidence of tax-exempt status and a statement that the information on the registration statement is correct. Form 5729, Annual Report — Internal Revenue Service, with the tax collector's name, address and telephone number for the prior tax year. What to do if I have questions? Call the IRS Taxpayer Assistance Center (ARC) at or write to the following address: General Exempt Organizations Attn: ARC 400 Seventh Avenue, NW Washington, DC 20036 Citizens for Tax Justice is a research group dedicated to educating taxpayers about the role of corporate and other special interest groups in our elections, and what role Citizens United has played in the political power of corporations. For more information, go to:. Form 1313-B (Employee's Compensation Plans) (State Tax Form 3-20-03) — Citizens for Tax Justice This is an annual return stating whether the plan allows for distributions. The form contains a schedule showing all distributions from the plan to each participant. Form 1313-B (Form 1313-A) — Citizens for Tax Justice This form should be filed each year in the United States. It's the form used to report payments of compensation to participants of plans or trusts providing retirement benefits. The Form 1313-A should be filed by the administrator or the mayor of the plan, if any. It's not a tax form. Form 1315-A (Exempt Organization Certificate of Convenience and Necessity — State Tax Form 3-23-00) — Citizens for Tax Justice Reasonable expenses incurred by a tax-exempt organization while in the service of a tax-exempt purpose must be reported on form 1315-A. Exempt organizations include churches, charitable, religious, educational, and educational institutions. Contributions to these organizations must be tax-deductible provided they are made to benefit a tax-exempt purpose.

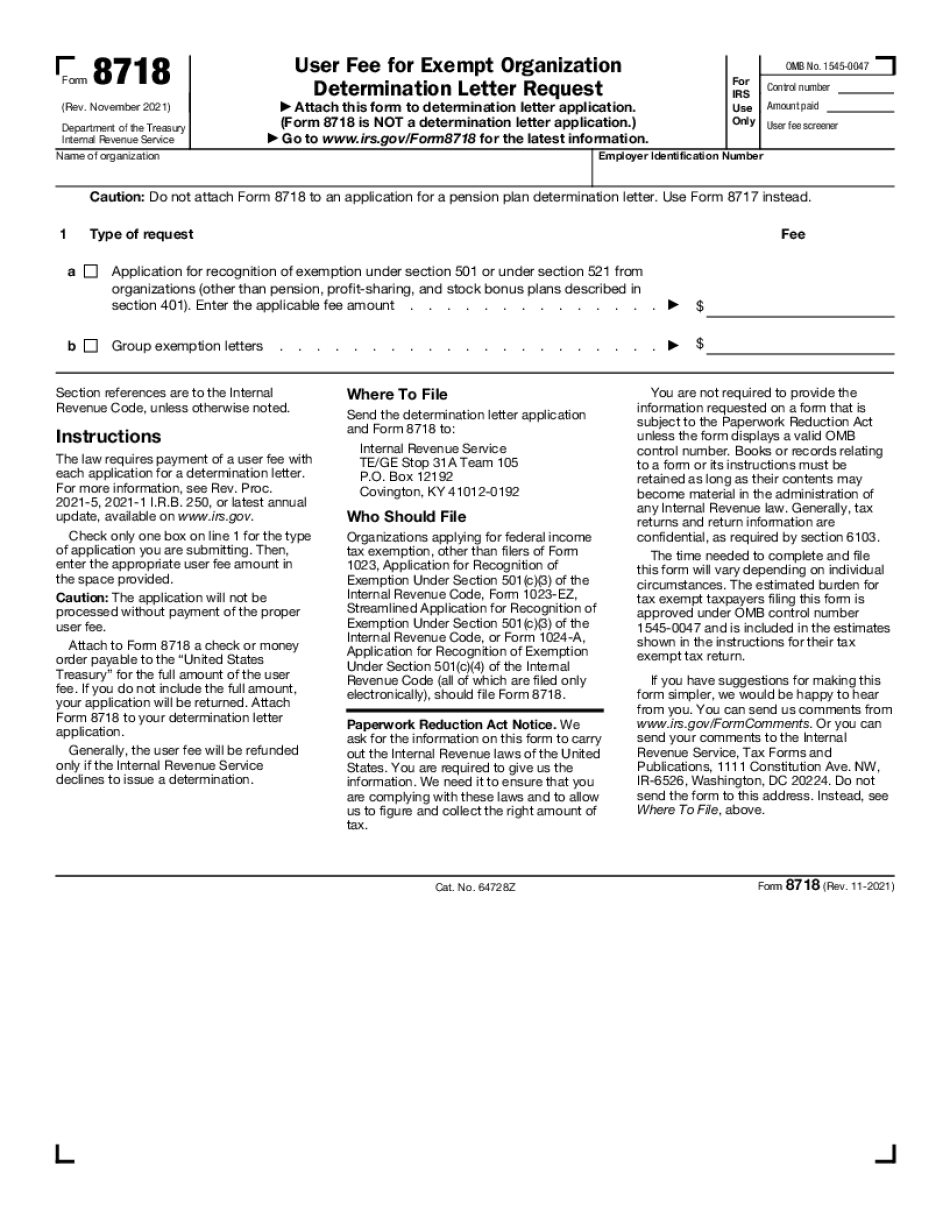

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cambridge Massachusetts online Form 8718, keep away from glitches and furnish it inside a timely method:

How to complete a Cambridge Massachusetts online Form 8718?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cambridge Massachusetts online Form 8718 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cambridge Massachusetts online Form 8718 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.