Award-winning PDF software

8718 Instructions Form: What You Should Know

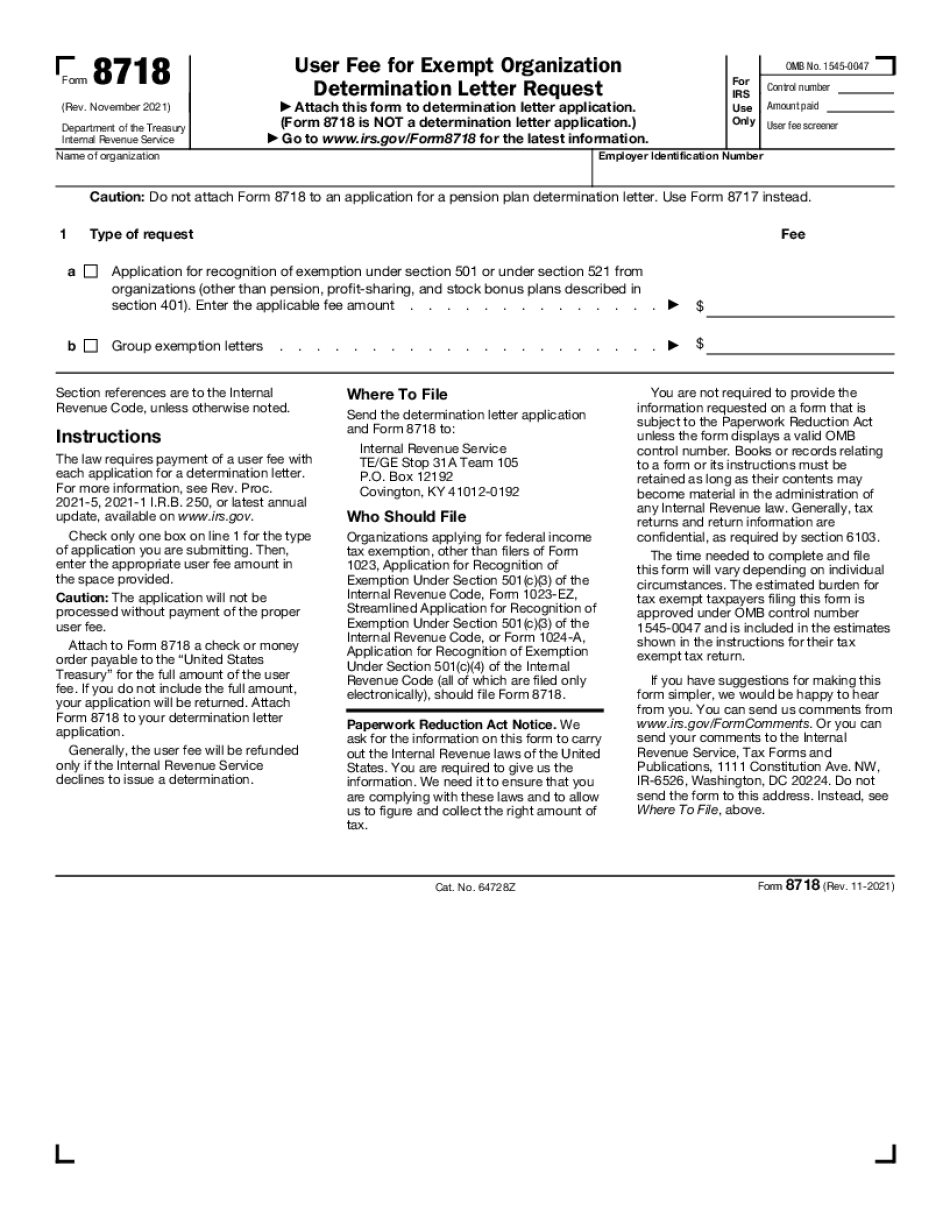

Individuals who do not pay federal income tax or do not owe tax. Family members who are not U.S. citizens or lawfully present in the United States. Citizenship or status in a foreign country Does not have to be IRS Form 8718. For example, form 1099A, 1099-B or 1099-MISC if filed electronically. Request to the IRS. Form 8718 (1-2010), with instructions. The IRS must approve the request based on all the information provided in the user fee determination letter, including, when appropriate, information describing the nature and extent of income and expenditures for related bona fide religious, charitable, scientific, literary, educational, political or other similar purposes. The IRS will determine whether income and expenditures for related and related and unrelated bona fide religious, charitable, scientific, literary, educational, political or other similar purposes are of sufficient scale and magnitude to form a substantial part of the net income. The IRS will also determine whether the religious, charitable, scientific, literary, educational, political or other similar purposes fall within one of the 10 exemption categories. What do I need to file a Form 8718? The form can be completed by a single individual or two or more individuals who are related to one another and must include the names and addresses of all partners. When using multiple-income form 8718, you must complete all required forms individually (for example, Form 1040A and Form 1040C), then attach the summary schedules with your return to the form 8718. The forms must be filed electronically in the same system that forms are filed, for example, the file system. All forms you must electronically file must reflect the same information. For more information, see Pub. 524. For a complete list of all exemptions, see Pub. 524. For a complete list of the categories of expenses that may be claimed for which you may claim a Form 8718, see Pub. 1 2. For a complete list of all tax-exempt entities, see Pub. 111. For a complete list of the tax-exempt organizations, see Pub. 1023. The IRS accepts Form 8718 by mail or on-line up until the date listed above on the return for the application you filed, and you must file this form before the date of IRS determination. You will receive an electronic notification when Form 8718 is received, so you can print, complete and file your return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to Do Form 8718, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8718 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in Your Form 8718 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to Your Form 8718 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.