I think accounting methods, for most people, these are probably pretty esoteric ideas. But, you know, as an accounting method specialist, you know, we had a lot of fun talking about it. Well, I guess as a fellow tax geek, I enjoyed it as well. Include a link to the letter and showing us at the episode, so the other tax geeks out there can enjoy it as well. Perhaps, absolutely! Applause Music. Simply tax. Hello and welcome back to another episode of Simply Tax Addiction-Related Guidance. Back in episode 21 of the podcast, I had a chance to chat with OBO a Kokoro about the AI CPA's tax methods and periods technical resource panel. In our conversation, she shared some of the issues that small business taxpayers face in implementing some of the favorable accounting method changes under the Tax Cuts and Jobs Act. Due to challenges in coordinating the new tax law with the old, on July 23rd, the resource panel submitted a letter to the IRS and Treasury that commented on this impact and made a number of recommendations that fall into eight buckets. Ranging from automatic and simplified accounting method changes to clarifying that qualified improvement property is treated as fifteen-year property, which was fixed the so-called retail pledge that we've previously discussed in the podcast. Stay in Simply Tax. I'm joined by Nathan Clark, who is a tax partner at Dixon Hughes Goodman and a member of the tax methods in signal resource panel. I'm excited to share with you his insights on the recommendations made in the letter, as well as the guidance we received by way of Revenue Procedure 2018-40 that was released on August 3rd. And you won't want to miss the end of the episode when Nathan shares how he's able...

Award-winning PDF software

Rev proc 2025 3 Form: What You Should Know

Clarification on Rev. Code Tit. 25, § 536(e), regarding the IRS notice of assessment for foreign financial accounts Jan 8, 2025 — The IRS will consider a claim on an insurance policy for the purpose of determining the tax liability of a taxpayer. The IRS will consider an award or payment on an insurance policy for the purpose of determining the tax liability of the holder under a life insurance policy, which may include an annuity Dec 31, 2025 — Income and deduction and FTA adjustments reported on a Form 1040-X. The income and deduction adjustments reported on a Form 1040-X do not apply to qualified dividends received to the extent they exceed the amount paid during the previous year to a qualified employer plan. Rev. Stat. 26-1301 and 26-1302, Exempt Organization Taxation, and 26-1601.1 and 26-1601.2, Regulations Under Sec. 501(c)(3), in effect on January 3, 2022, Tax Notes, Vol. 31, No. 9, Jan. 2018 Nov 28, 2018—The IRS announced Dec. 31, 2022, as the final day to file tax returns for the 2025 tax year.

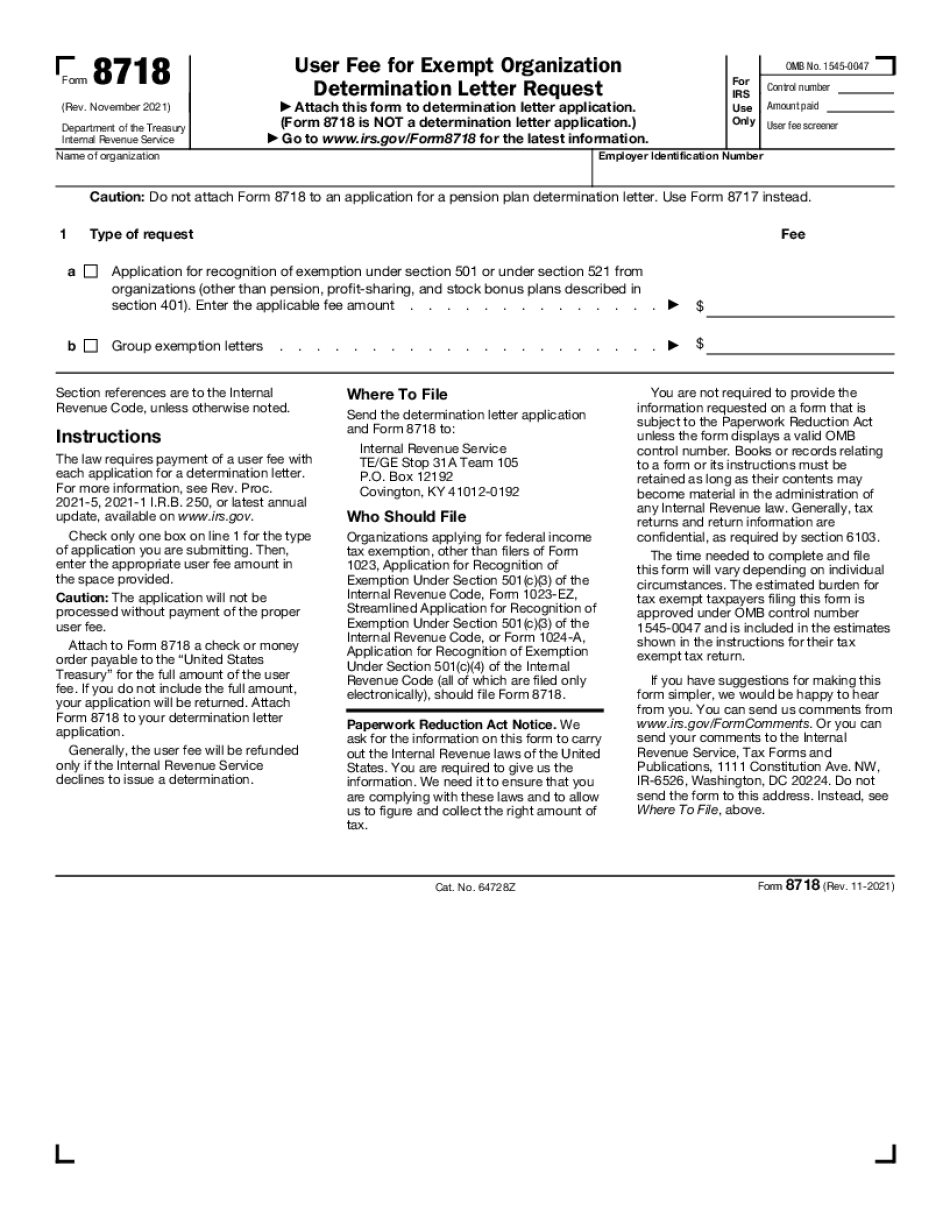

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to Do Form 8718, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8718 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in Your Form 8718 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to Your Form 8718 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Rev proc 2025 3