Award-winning PDF software

501(c)(7) filing fee Form: What You Should Know

Are there tax-exempt organizations that I can apply for a certificate of exemption from? What are the minimum requirements to be granted tax-exempt status? Where can I find more information about nonprofit corporations? Form 8802 — Tax Exempt Organization Certificate (Form 8802-T) — Texas Secretary of State I am an individual with taxable income (or other specified gross income) of more than 250,000 in any calendar year. How can I be an eligible organization? The IRS requires only a name, address, and number of officers to form a tax-exempt organization. However, a group of 10 or more persons can form a tax-exempt organization if they comply with other requirements. The IRS has established a list of tax-exempt organizations that do not have specific restrictions but can be formed by a group of individuals if that is the only qualifying requirement. The group can include a public or a private organization, but each person or group must file a separate application for approval, and the group must file separately. Form 8802 — Tax Exempt Organization Certificate (Form 8802-T) — Texas Secretary of State Form 8802 — Tax Exempt Organization Certificate (Form 8802-T) — US Government Accountability Office Form 8801 | IRS Application for Certificate of Exemption I want to form a tax-exempt organization — I live in one of the following states: AL AK AZ AR CA CO CT DE FL GA HI ID IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY or out of state. How can I avoid having to mail in Form 1023 for my organization? You can avoid sending the Form 2025 to tax authorities if you have the following: An affidavit that the organization meets the criteria listed in section 501(c)(3) of the US Internal Revenue Code. An explanation of why you believe the organization meets the criteria. Please note, if you do not have a current IRS Form 2027, you can still do a search on the IRS Form 1023 website. My organization is a 501(c)(4), but don't meet one of the criteria for tax-exempt status.

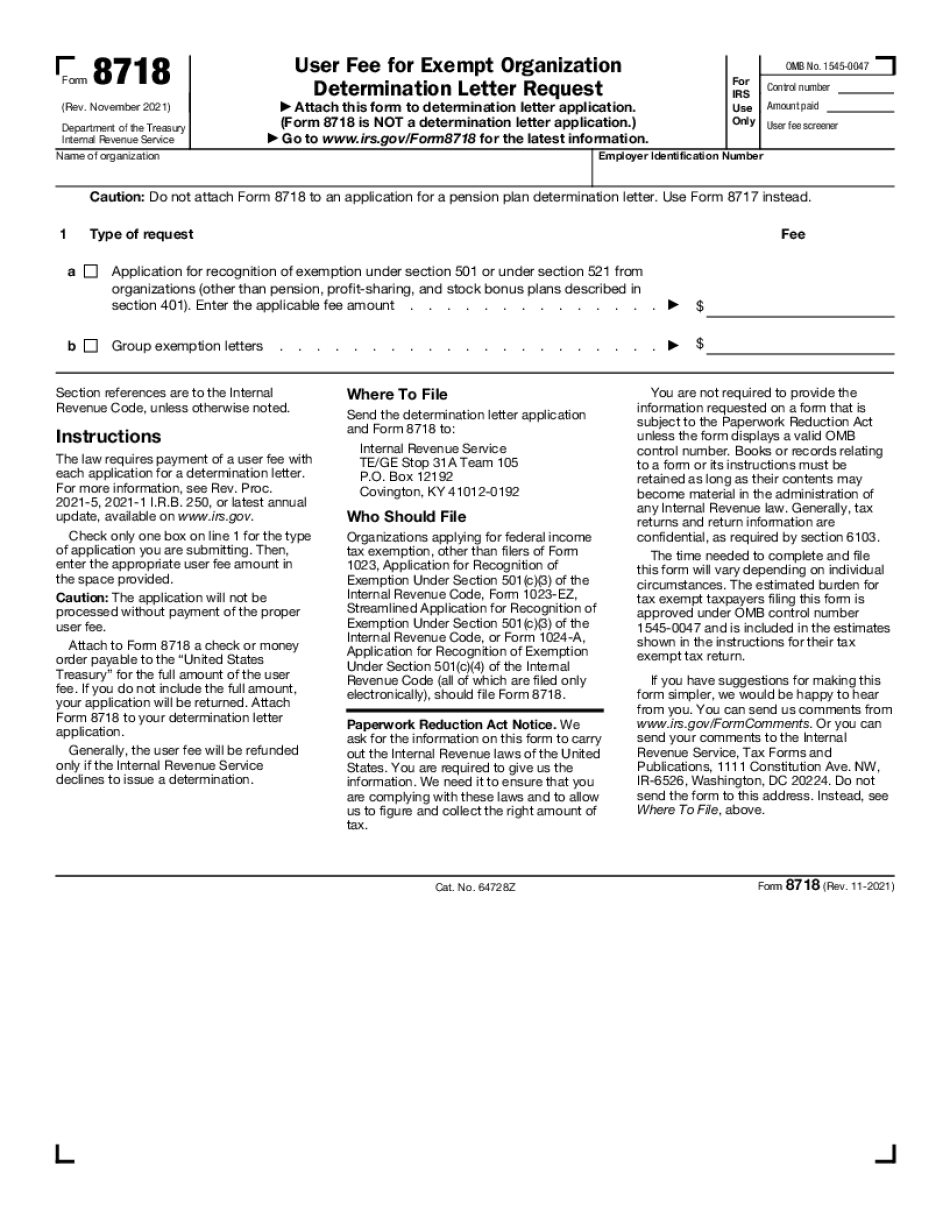

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to Do Form 8718, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8718 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in Your Form 8718 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to Your Form 8718 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.