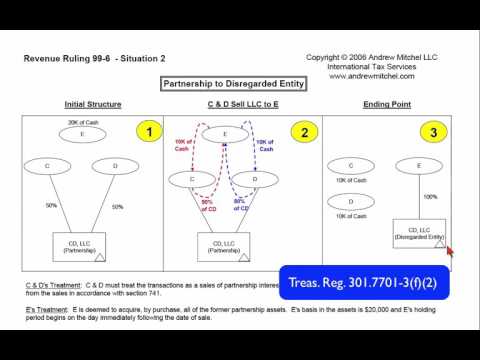

In Revenue Ruling 99, there are six situations outlined. In the first situation, C and D each owned 50% of an LLC that was taxed as a partnership. In the second situation, C and D each sold their partnership interest to E for $10,000 worth of cash. As a result of this transaction, the LLC changed from having multiple members to having a single member. Because of this change, the LLC converted from a partnership to a disregarded entity. The ruling held that C and D were treated as having sold partnership interests and that E was treated as having acquired assets of the partnership directly.

Award-winning PDF software

Rev. proc. 2021-5 Form: What You Should Know

Rev. Pro. 2021-5, 2017-1 I.R.B. 1321. The Rev. Pro. Establishes a new provision in the Internal Revenue Manual with respect to the consideration of, in considering the Form W-4, whether an employee who files an FAFIEC application at the same time as a Form W-4 is considered an employee for federal income tax purposes. This replaces the section on Form W-4 Consideration in the previous Rev. Pro. 2016-10, 2017–2 I.R.B. 1232. These revisions to the Rev. Pro. Are effective March 17, 2017. Jan 4, 2021. Decisions are in the Tax Notes and all subsequent Rev. Pro. Are available at the links provided. The following topics will be addressed if found of interest in the course of your own research: IRS Form W-4 (with Form W-2 and Form W-4 attached to Form W-2, Schedule E) A Form W-4 shall be signed by every member of the person's household, the following requirements being met: Form W-4 (with any statement attached) is signed and properly completed and notarized Form W-4 (with any statement attached) provides information that is included in Form W-2; and Forms W-2 (with any statement attached) and Form W-4 can accompany the application. The IRS has issued a Statement of Organization Notice that clarifies the requirements set forth for Form W-4 signatures. Form W-4 (with any statement attached) is signed and properly completed and notarized, and filed with the IRS and with any other federal tax authorities by a person, or by a person's authorized representative, as provided in the statement, in any form to be required by the IRS and by any other federal tax authorities. The IRS has adopted procedures that require a Form W-4 (with any statement attached) to be signed and properly completed and notarized before its use, regardless of whether a statement was attached to the form.

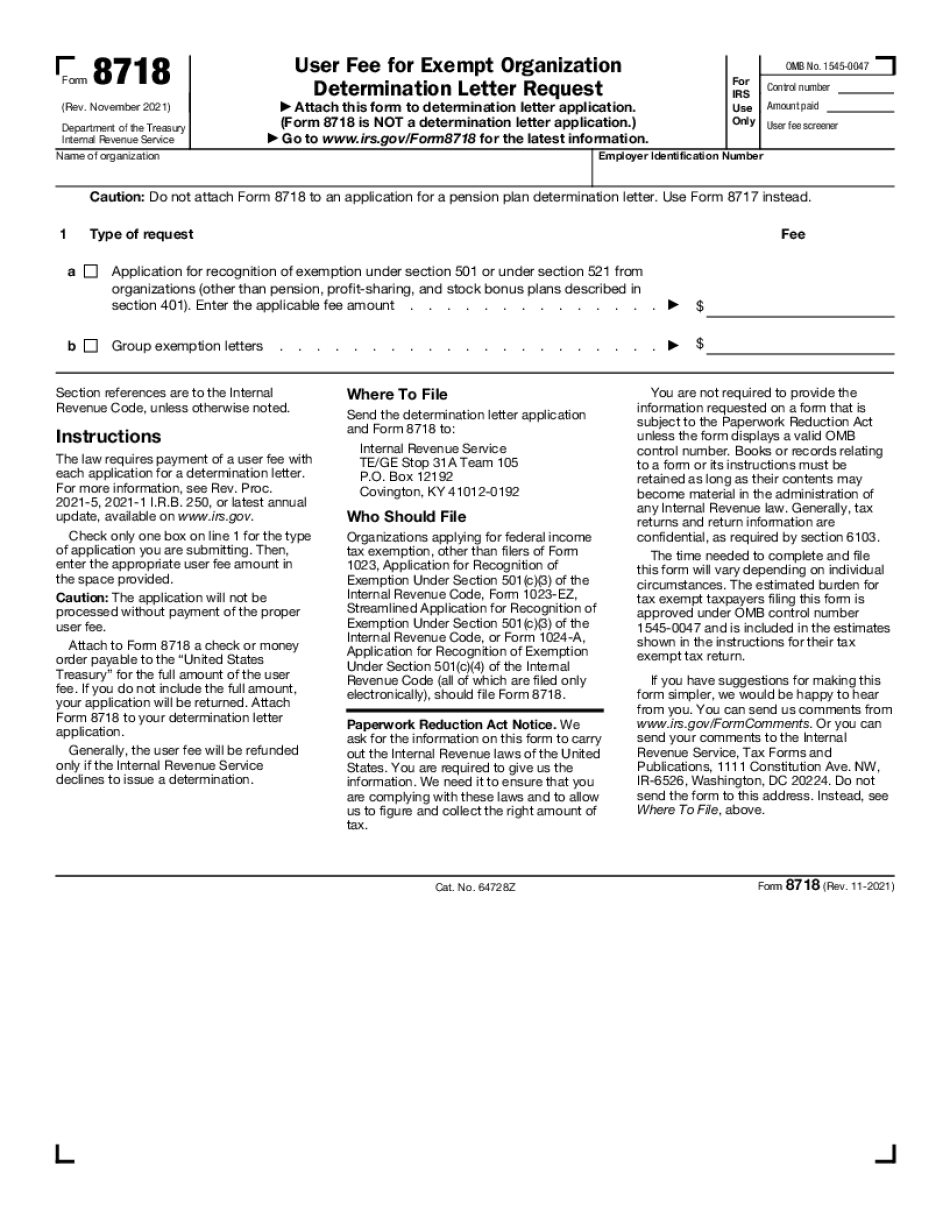

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to Do Form 8718, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8718 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in Your Form 8718 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to Your Form 8718 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Rev. proc. 2021-5