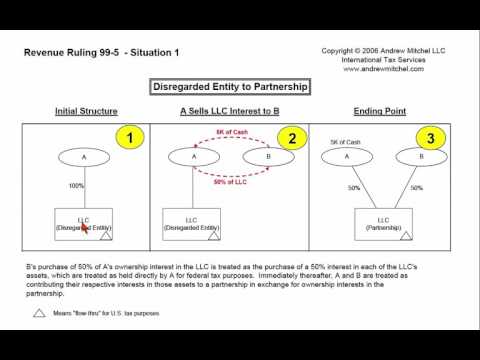

Revenue Ruling 99 - five situations were discussed in the following text. Situation one focused on the conversion of a disregarded entity to a partnership by selling an interest in an LLC. In this ruling, individual A owned 100% of the LLC, which was treated as a disregarded entity for US tax purposes. Consequently, the assets of the LLC were considered to be owned directly by individual A. However, individual A decided to sell 50% of the LLC to individual B for a cash payment of $5,000. As a result of this ownership change, the LLC was classified as a partnership for US tax purposes. The ruling stated that two steps were involved in creating the partnership. First, individual A was treated as if they had sold a 50% interest in all of the LLC's assets to individual B. Second, both individual A and B were considered as if they had contributed their respective 50% interests in the LLC's assets into the newly formed partnership.

Award-winning PDF software

See rev proc 2025 5 2025 1 irb 233 Form: What You Should Know

Taxpayers requesting the issuance of letter rulings should be mindful of the following three principles: the taxpayer should seek and have received a determination letter of the correct tax due. The Associate will not provide a letter ruling unless the Taxpayer requests the issuance of the letter ruling and demonstrates to the Associate that a letter ruling is necessary to determine a Taxpayer's account tax liability. The Associate will not accept the proof of tax liability required by the Taxpayer, unless the Commissioner approves the proof. If the Associate does not receive a request for a letter ruling, he/she must inform the Taxpayer that the Taxpayer will not have the correct tax due on their account, and that the Taxpayer should contact a State revenue officer (i.e., their state tax agency) to pursue the case. This procedure also provides guidance to individuals who provide information to the IRS regarding the proper assessment of tax liabilities. If the Taxpayer requests a letter ruling from the IRS and the Associate does not grant the request, the IRS cannot accept a copy of the letter ruling that would include an explanation that the Taxpayer is not entitled to a letter ruling because the IRS is not a federal agency; the letter ruling was issued by an 'Internal Revenue Agent' (see Rev. Pro. 2021-3, 2011-18 Run. 1, para. 16) (this applies to state tax agents who have the authority to issue 'tax rulings'). Accordingly, any requests for information or letter rulings from the IRS would generally be denied, if the IRS ever receives a request for letter rulings. However, if you have a claim in your Form 1040 or 1040A that shows the right tax period was determined incorrectly, you should seek to have that assessment corrected. Once the Associate determines the correct tax period is being assessed, a letter ruling may be issued by the IRS within 10 days if the Associate does not have all the required information to complete the letter ruling.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to Do Form 8718, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8718 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in Your Form 8718 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to Your Form 8718 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing See rev proc 2025 5 2025 1 irb 233